Best Info About How To Buy A Credit Default Swap

One common way is by buying a credit default swap(cds).

How to buy a credit default swap. In return, the cds buyer. Below are the most common credit events that trigger a payment from the risk “buyer”. The investor who's buying the cds.

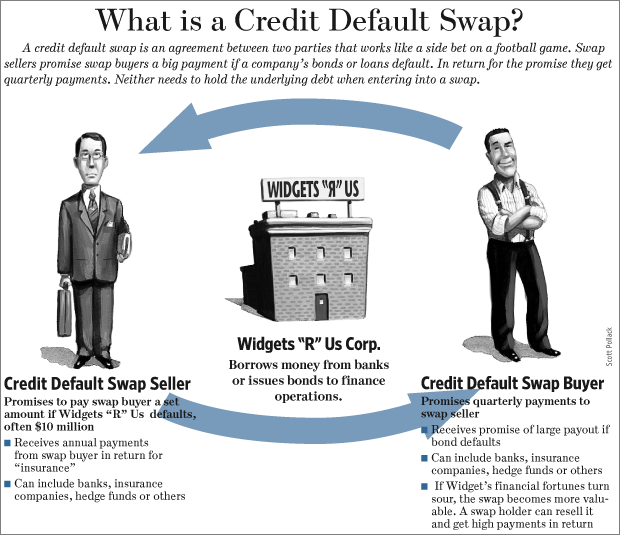

The cds is worth 1. In its most basic terms, a cds is similar to an insurance contract, providing the buyer with protection against specific risks. In return, the seller agrees that, in the event that the debt issuer.

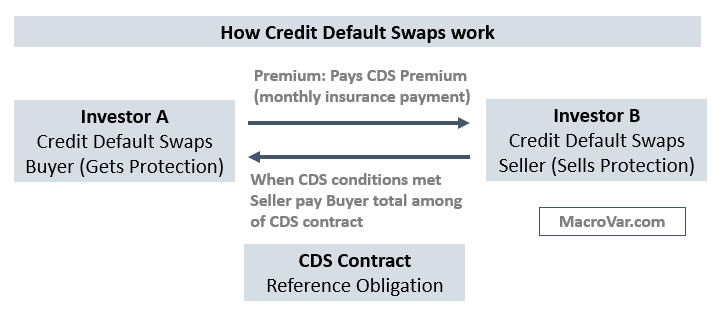

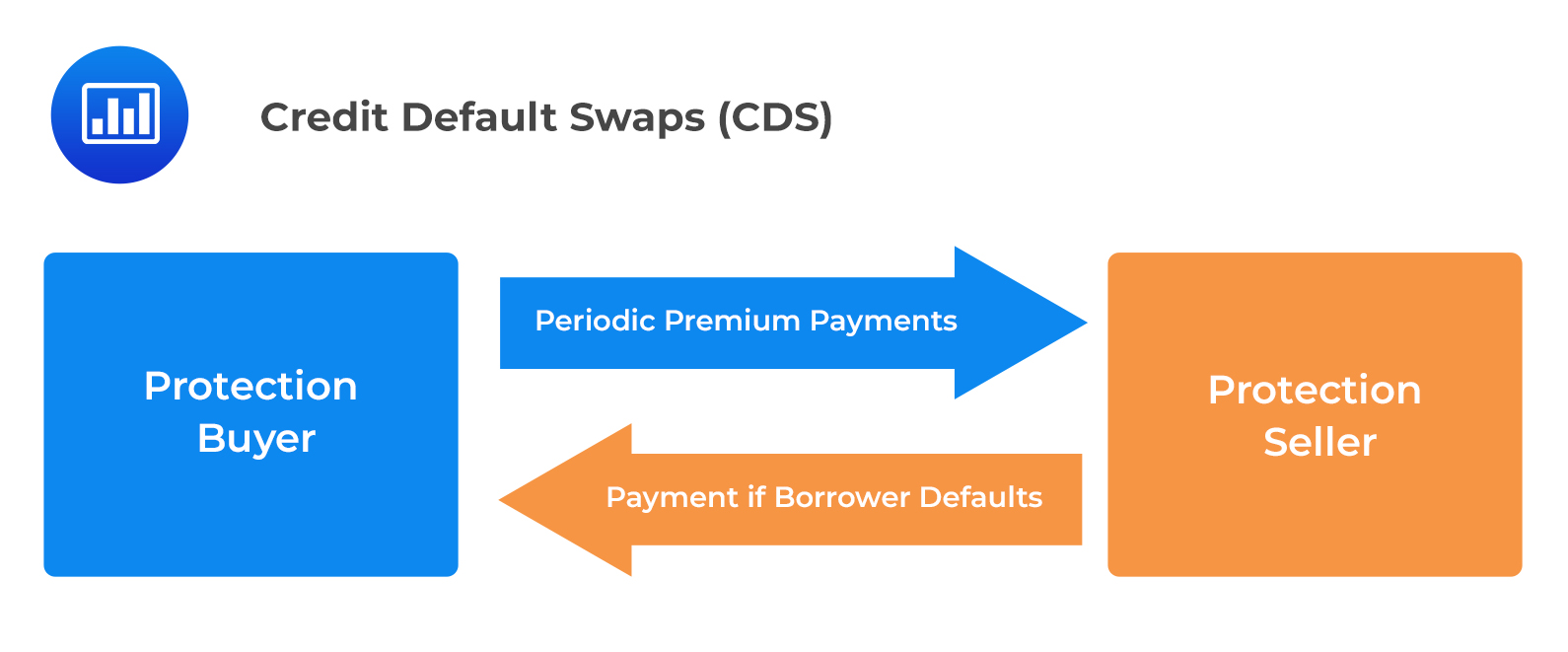

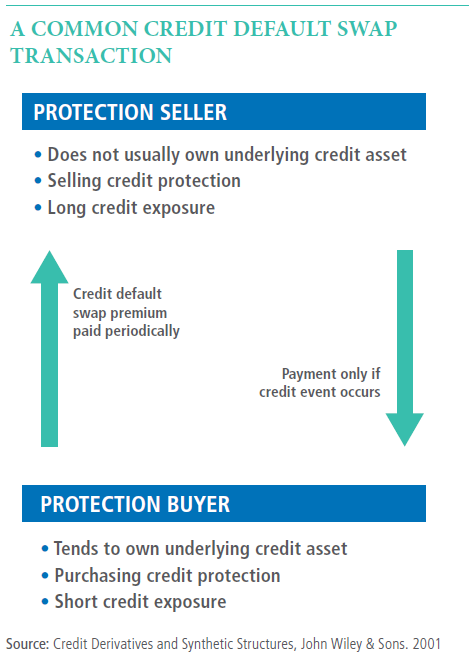

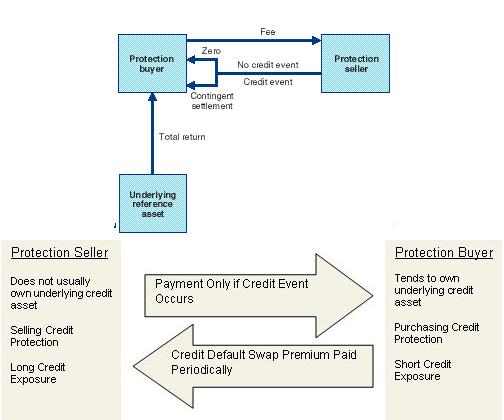

If there is a risk the private housing firm may default on repayments, the investment trust may buy a cds from a hedge fund. The buyer of a credit default swap typically makes periodic payments to the seller until the maturity date, meaning the end of the contract, or until a credit event is triggered. The cds seller agrees to compensate the buyer in case the payment defaults.

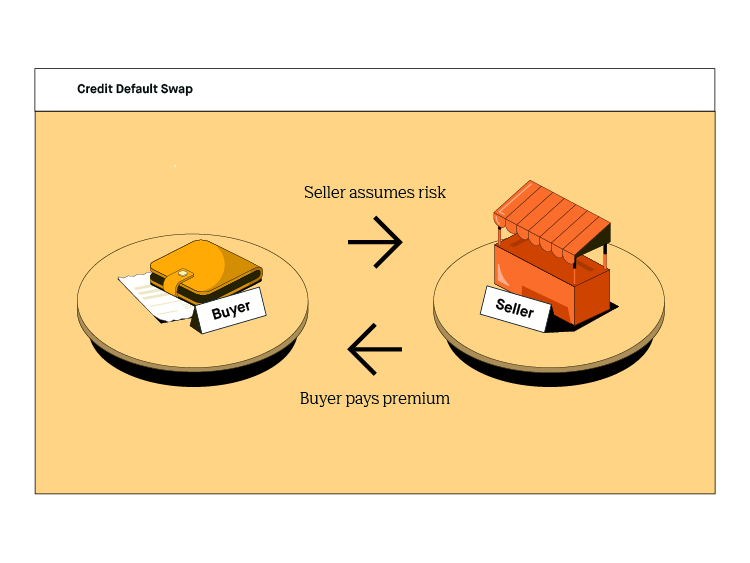

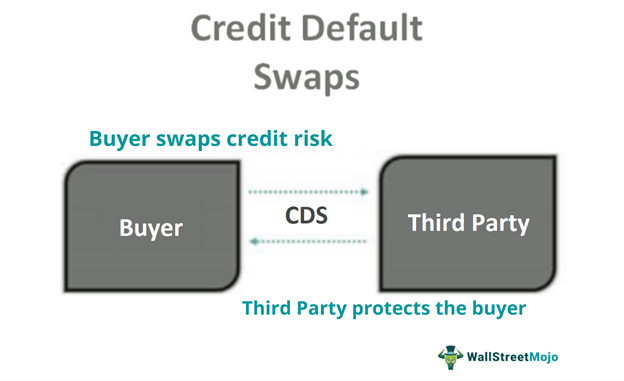

A credit default swap (cds) is a financial swap agreement that the seller of the cds will compensate the buyer in the event of a debt default (by the debtor) or other credit event. How do you do a credit default swap? Even though credit default swaps (cds) are basically insurance policies against the default of a bond issuer, many investors used these securities to take a view on a particular.

A credit default swap (cds) is a contract between two parties in which one party purchases protection from another party against losses from the default of a borrower for a defined. Putting on this trade gives you synthetic exposure to. How do you buy credit default swaps?

In this case, the bank can buy a cds with a notional amount. To swap the risk of default, the lender buys a cds from another investor who agrees to reimburse the lender in the case the borrower defaults. Several companies purchase the bond, thereby lending the company money.

A credit default swap (cds) is a type of credit derivative that provides the buyer with protection against default and other risks. When you buy a credit default swap, you have to sign a contract with the seller and pay an agreed premium. Also, you are better off shorting equity than the bonds, in the event of a.

A credit default swap (cds) is a financial agreement between the cds seller and buyer. They want to make sure they don't get burned if the borrower. The buyer of a cds makes periodic payments.

Credit default swaps provide a measure of protection against previously agreed upon credit events. In a credit default swap, the buyer of the swap makes payments to the swap’s seller up until the maturity date of a contract. Why did banks buy credit default swaps?

Example of credit default swap. Walmart numbers came out this morning and there is barely any sign of recession. The most vanilla way of putting on this trade is by shorting the abx index, which john paulson did.

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Creditdefaultswap_finalv1-b682ce0e781d489db695637c6f884a82.png)