Fabulous Info About How To Buy A Futures Contract

Understand he leverage and specifications.

How to buy a futures contract. Oil futures stop trading on the third day before the 25th calendar day of the month prior to the contract month. The contract specifies when the seller will deliver the asset and what the. Therefore, the two parties enter into a futures contract to lock in the price and exchange the.

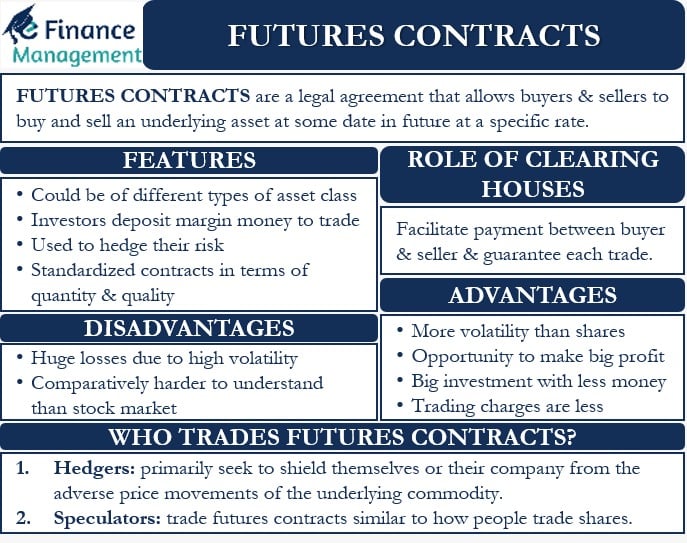

Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument , at a. Buying a futures contract is not like buying shares. The bullish party seeks to buy the equity, while the bearish party seeks to sell it.

Use a virtual trading account to practice trading. The standard account can either be an individual or joint. Trading in futures contracts is a huge part of the financial industry, but it can be pretty tricky for novice investors.

To start trading futures with charles schwab futures and forex llc, you’ll need to open a standard account. The futures contract buyer enters a legal agreement to buy the underlying asset at the contract’s expiration date. The global foreign exchange market accounts for over $5 trillion u.s.

If it trades at 5$, the. Buying commodity futures directly requires entering a commodities market with the help of a broker or online brokerage. On the other side of the trade, the futures contract seller agrees.

Buying the future requires putting up an initial margin of $8,350; If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). For example, a crude oil contract futures contract on the chicago mercantile exchange (cme) is for 1,000 barrels of oil.

Futures are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price.here, the. Dollars worth of average daily trading volume. Forex futures are standardized futures contracts to buy or sell.

Conversely, we incur a $1,250 loss if we get stopped out. One of the key concepts in understanding futures trading is that, as leveraged investments, a relatively. Understand and prepare for the risks.

Some online brokers will allow you to set up a virtual account that trades with fake money. In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between. Futures trading education buying a futures contract things to consider when trading futures contracts.

At $75 per barrel, the notional value of the contract. Here are a few things you should know if you're interested. The latter option holds considerable risk, so think.

:max_bytes(150000):strip_icc():gifv()/futures-contract-4195880-01-final-02f6e035093b402fa53b5ade43f0760a.png)

/futures-contract-4195880-01-final-02f6e035093b402fa53b5ade43f0760a.png)