Unique Tips About How To Increase Quick Ratio

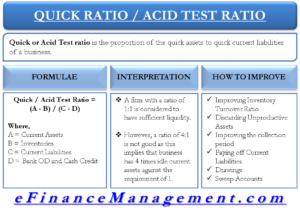

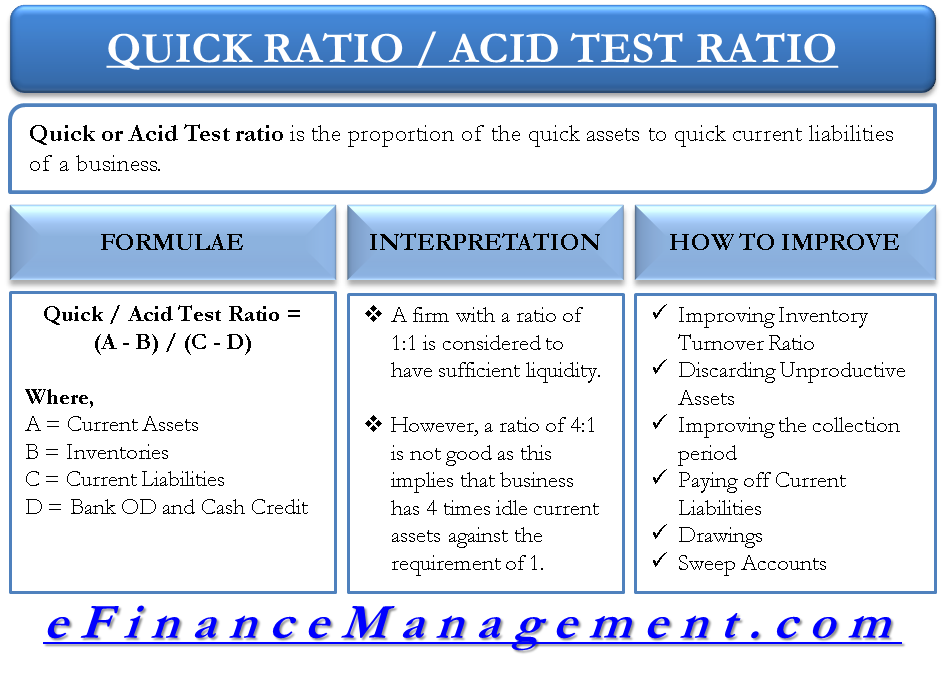

Web to improve the quick ratio, a company can increase its sales and inventory turnover, work on its invoice collection period and pay off liabilities at the earliest.

How to increase quick ratio. Web the most obvious way to swiftly increase your liquidity ratio is by paying off liabilities. Higher inventory turnover (greater sales) will mean that the inventory that cannot be taken into account while computing quick ratio may turn into cash more. Web to improve the quick ratio the company should consider making the assets more liquid the assets which are cash equivalents should be able to get converted into cash within 90.

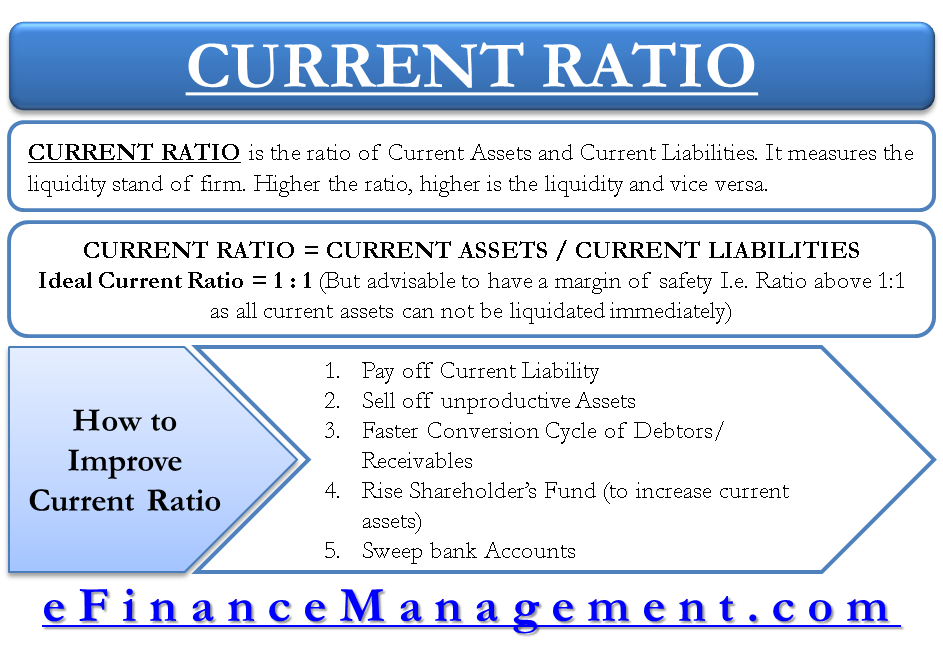

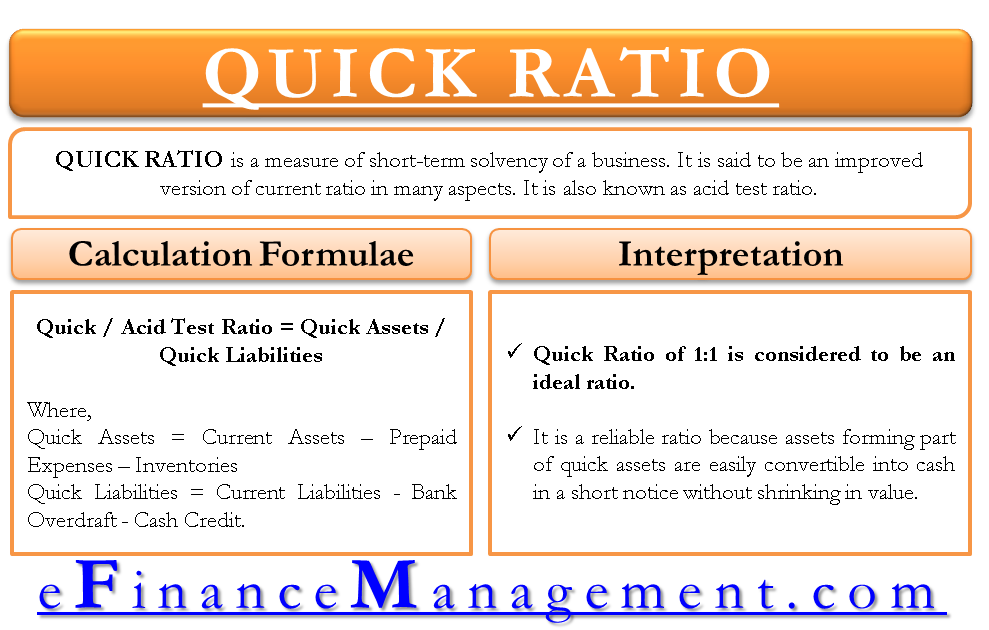

Web use the same debts as with the current ratio calculation. Web you’ll need to include the additional $150 into the quick ratio formula for accurate metrics. If you’re wondering how to improve quick ratio, boosting your current ratio will put you on the right path.

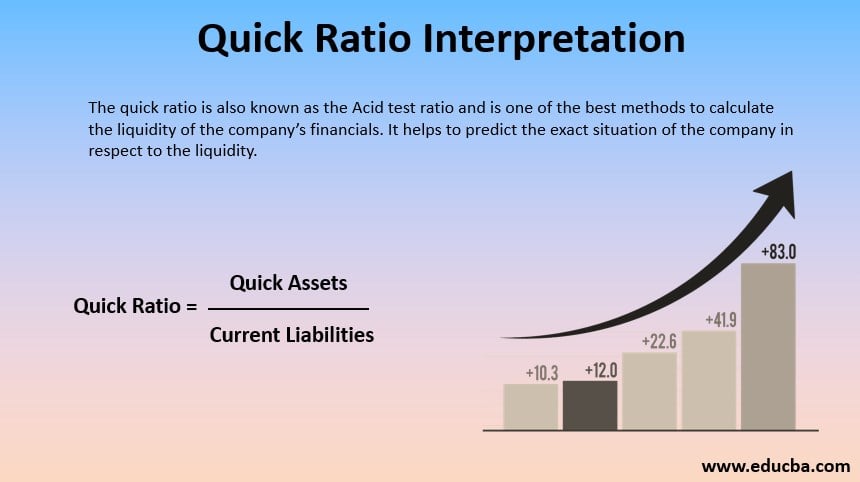

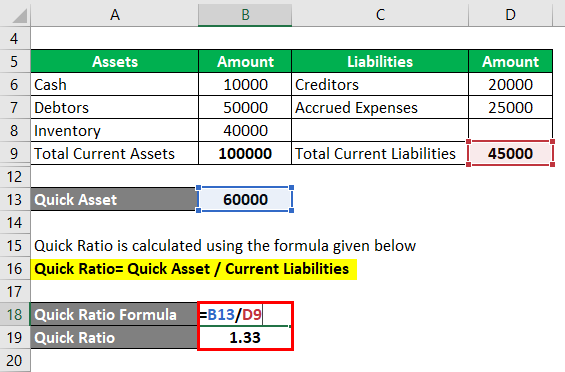

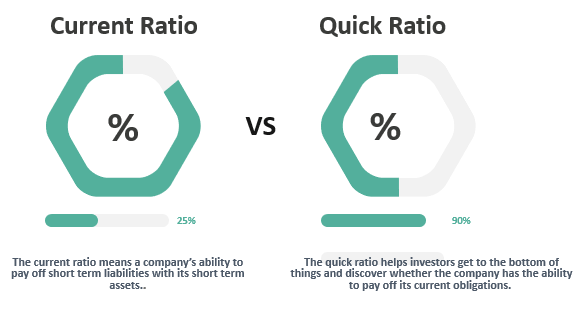

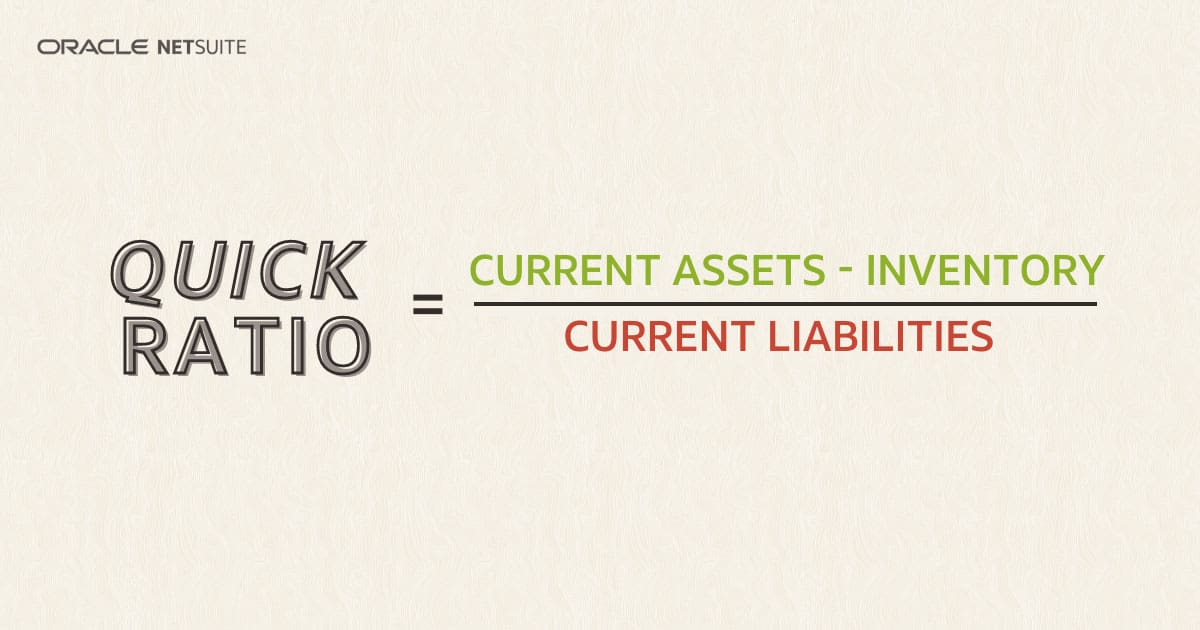

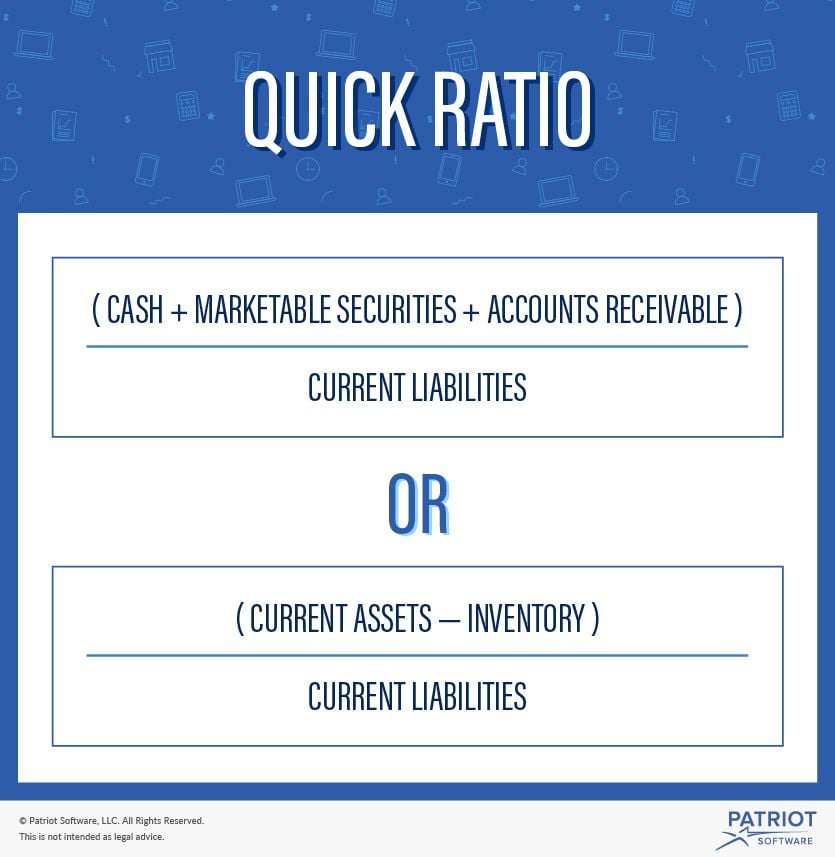

Web the current ratio uses any assets that can be converted into cash within one year versus the quick ratio limit of ninety days. Web the formula to calculate the quick ratio can be written in two forms: Web quick ratio = cash+ stock investments + accounts receivables/ current liabilities;

Quick ratio = (cash + marketable securities + accounts receivable) / current liabilities. Web there are a few ways to improve your quick ratio. Quick ratio = $10000+$2000+$6000/ $15000;

/terms-q-quickratio-final-52ee5110fc81457591d8108913ee6250.png)

/dotdash_Final_How_Is_the_Acid-Test_Ratio_Calculated_2020-01-e78bcddeb1dc41d29bcacaa0072bc773.jpg)