Breathtaking Info About How To Reduce California Property Tax

Up to 25% cash back method #1:

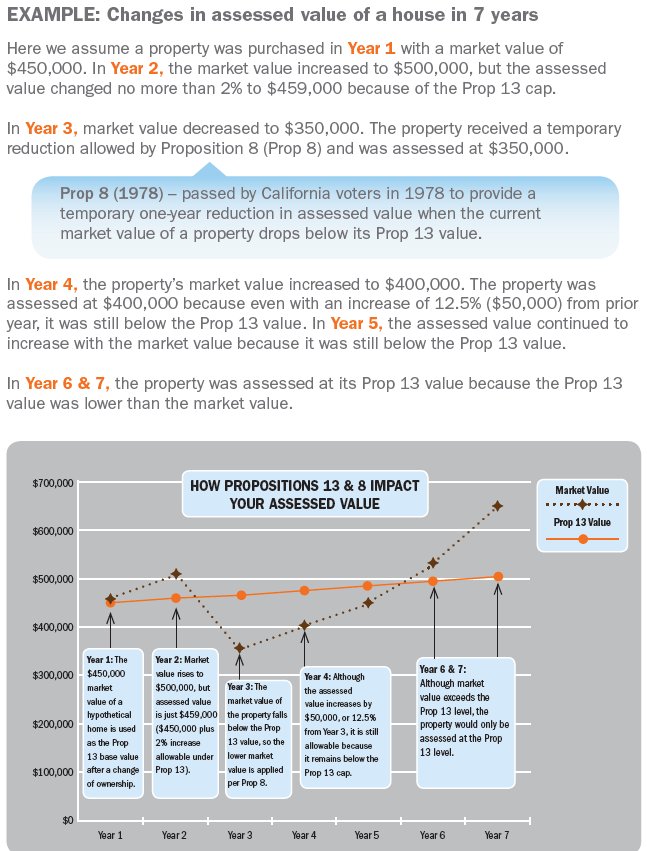

How to reduce california property tax. Failure to file proposition 8 appeal by september 15 of each tax year. California has 58 counties, and some variation in policies and procedures for calculating and assessing property. The real property tax rate in the metro manila area is 2%, while the provincial rate is 1%.

10 commonly overlooked ways to reduce california real property taxes. As a result, if your vacant land in california is worth $100,000, you will be required to pay. The boe acts in an oversight capacity to ensure compliance by county assessors with property tax laws, regulations, and assessment issues.

Tips to reduce property taxes in california. Contact your local tax office. Homeowners who believe they were overcharged for california home valuations might be able to reduce their california.

Homeowners exemption senior citizens exemption veterans exemption disabled. Appeal the taxable value of your home. Our software will scan your bank/credit card receipts.

The best way to reduce property taxes in california is to apply for one of the following property tax exemptions: So, if you are planning to file for. This video covers how property tax is calculated and how you can pay a lower overall property tax.

By the time you are already paying a certain amount, it's. Ask the tax man what steps you need to take in order to appeal your current bill. Here are a few steps you can take to cut your property taxes.

The easiest but most commonly. Tips to reduce property taxes in california.