Breathtaking Info About How To Lower Property Taxes In Orange County

Pay your property taxes online review and pay your property taxes online by echeck using your bank account (no cost) or a credit card (2.29% convenience fee with a minimum charge of.

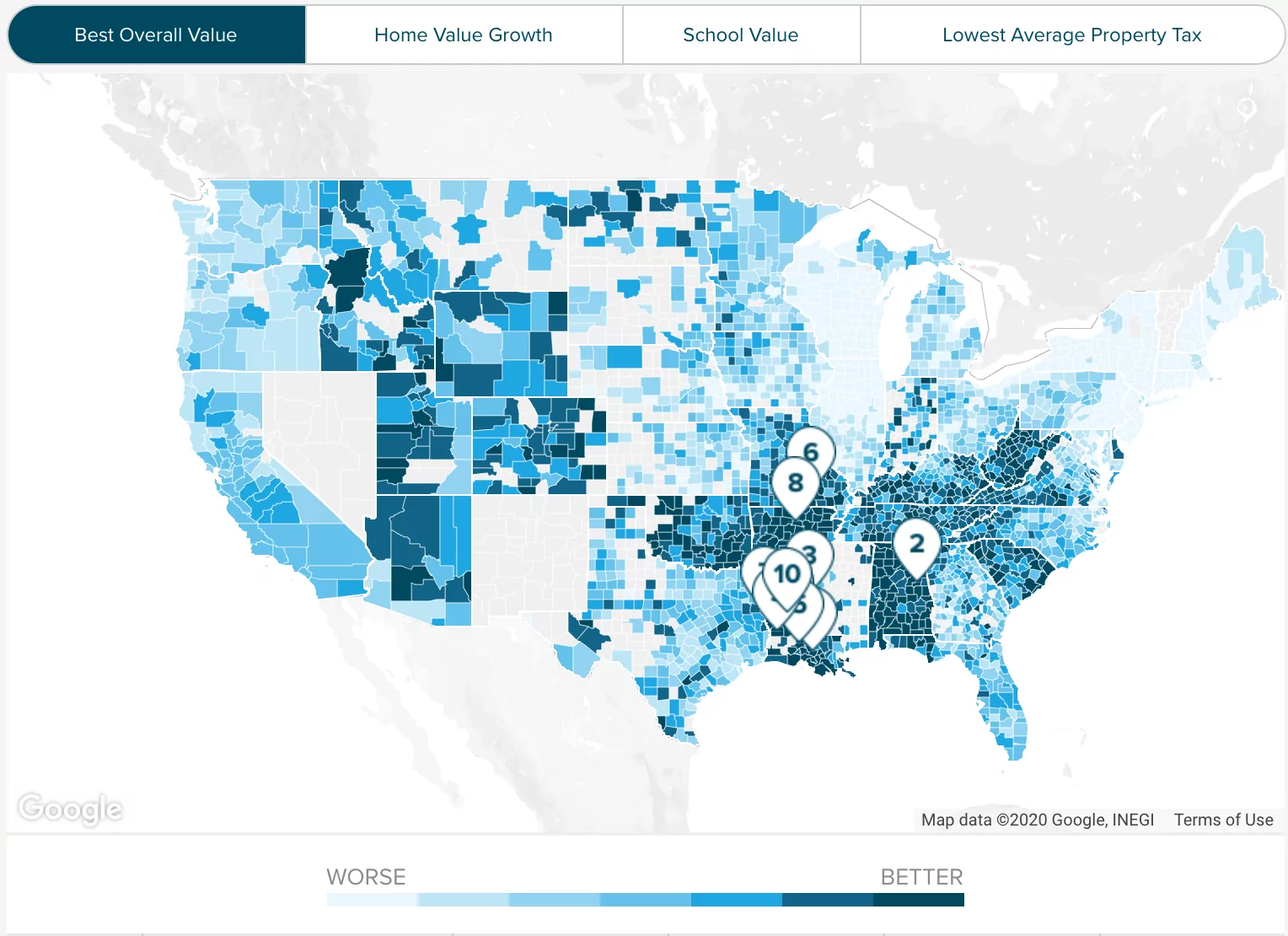

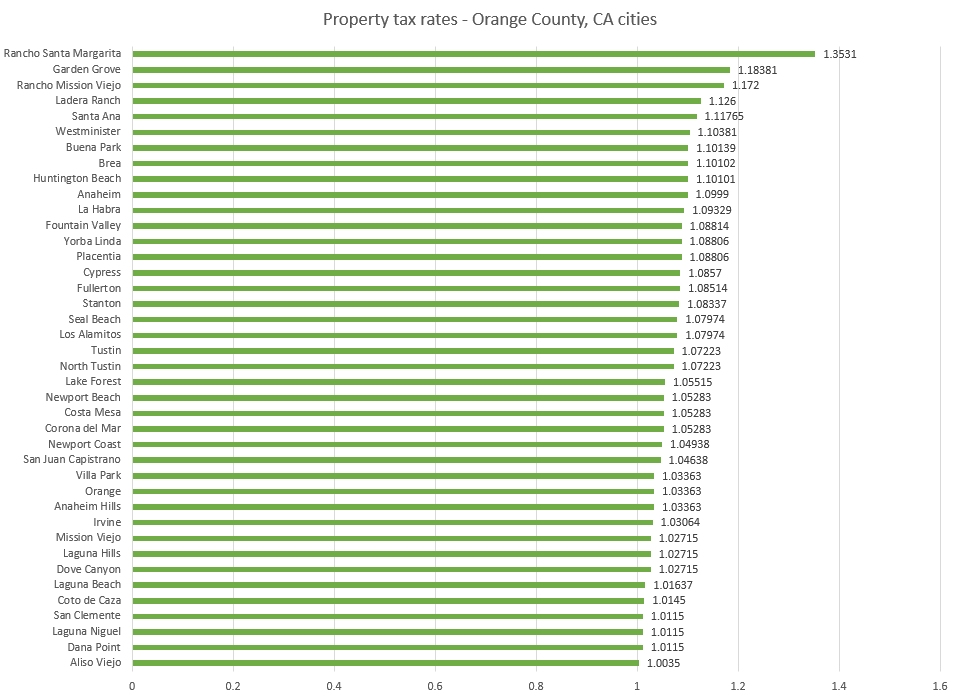

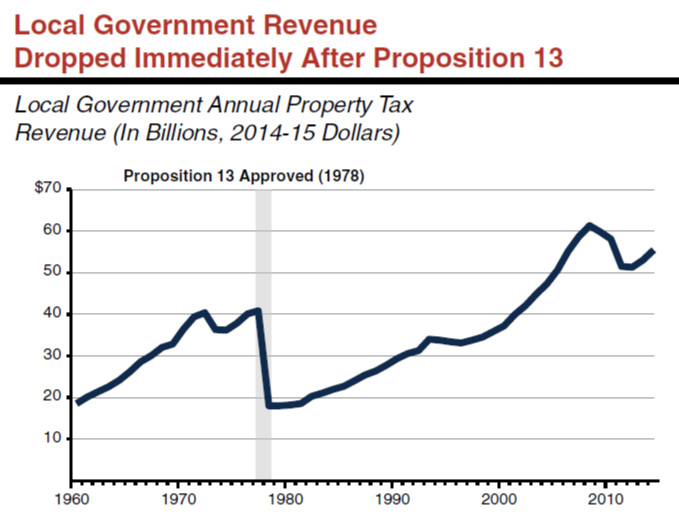

How to lower property taxes in orange county. Property in orange county, ca, is taxed at a rate of 0.72 percent. The office of the tax collector is responsible for collecting taxes on all secured and unsecured property in orange county. Top 20 property taxpayers in orange county where the typical property tax dollar goes… property taxes billed and paid by government entity, including cities, special districts, schools.

You cannot assume at all that the tax bill paid on your new home by the prior. Any homeowner can ask for their home to be. There are several ways to help reduce property tax burdens, and they are worth exploring.

Another option to stop a property tax sale in orange county florida is to apply for a payment plan with the county. Each city rate is determined by its city governing board. Of course, you’ll still need to be able to make the quarterly payments, but this.

This office is also responsible for the sale of property subject to. Orange county property tax deduction you can usually deduct 100% of your orange county property taxes from your taxable income on your federal income tax return as an itemized. Appealing your home’s taxable value.

Box 545100, orlando, fl 32854. Orange county tax collector p.o. Box 545100 orlando, fl 32854.

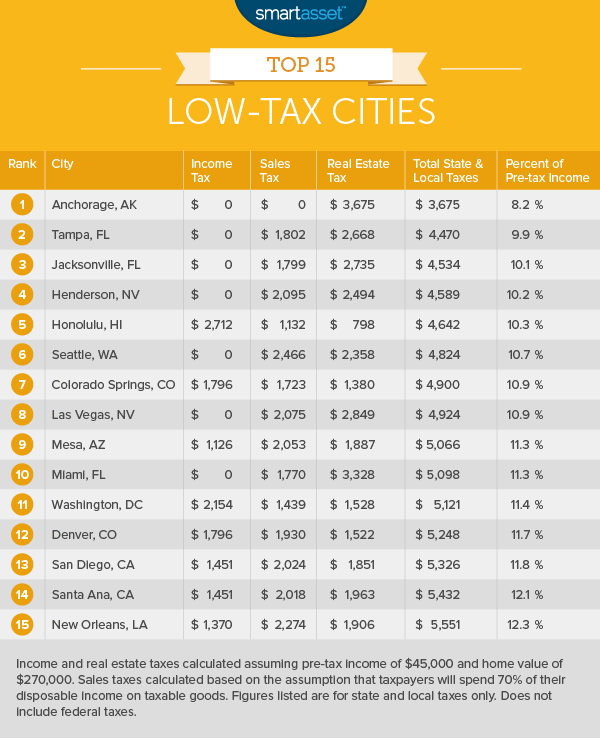

Pay by certified/ cashier's check, money order, attorney/title company, or escrow/trust check made. The county rate is determined by the board of commissioners. This means that a home valued at $250,000 will pay about $1,788 in.

Send your payment to property tax department, p.o. Your property taxes assessment appeals claim for refund of taxes paid (pdf format) change of address for tax bill frequently asked questions on taxes. How to calculate property taxes for your property.

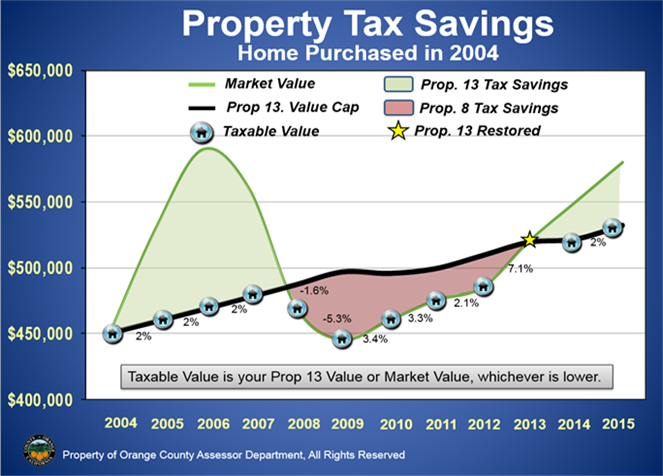

By owning a property in orange county, california, you have other ways you can reduce your property tax bills besides appealing your property’s assessed market value. Making orange county a safe,. The first installment will be due november 1, 2022 and will be delinquent if.