Fun Info About How To Find Out Much Property Tax You Paid

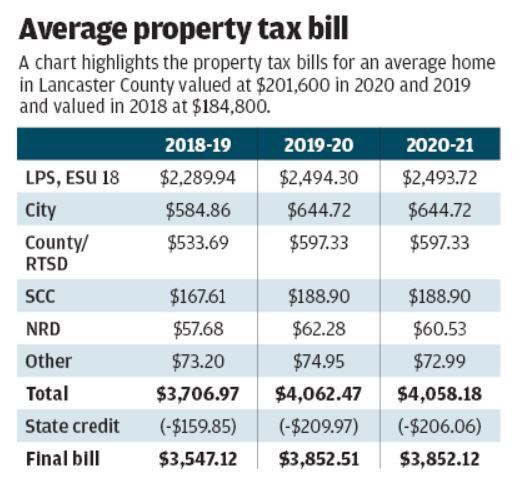

Property taxes are calculated by multiplying the assessed value of your home by the percentage of taxable value you pay.

How to find out how much property tax you paid. The state treasurer does not manage property tax. The property tax assessment determines the taxable. The department of revenue does not.

Your lender sends this to you by jan. By clicking on ‘know property tax dues,’ you can obtain a list. Tax rebate checks are going out in several states in september and october.

Turbotax online makes filing taxes easy. An interim tax bill is mailed out in early february with instalments due the last. Ad find out the market value of any property and past sale prices.

Your lender sends this to you by jan. Either of these two county websites is a good. Try it for free and pay only when you file.

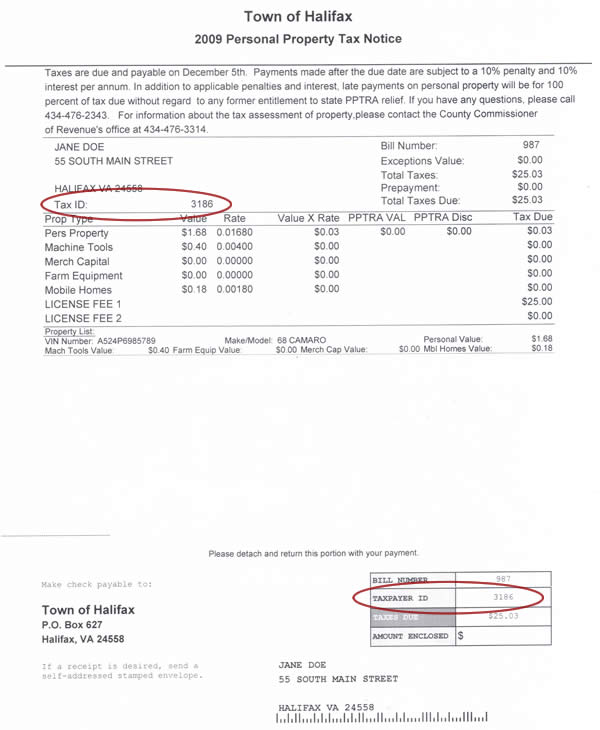

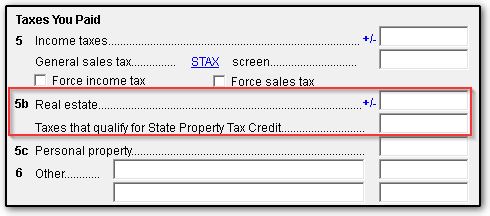

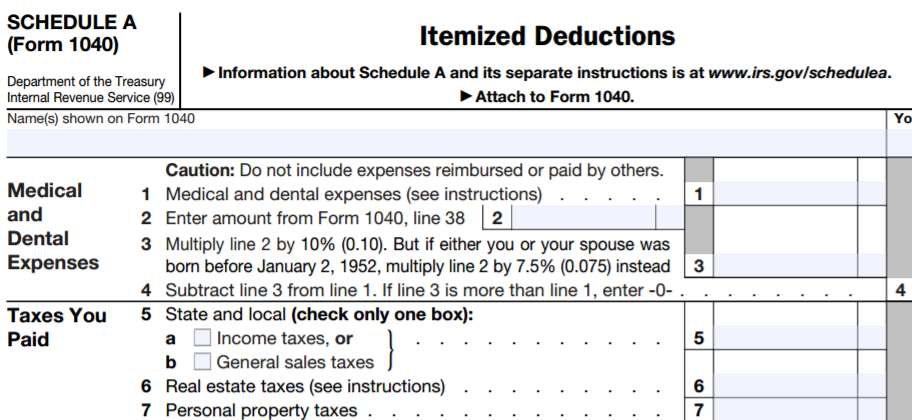

Log in to the ghmc website to calculate your property tax. You can find out the total amount of property tax you paid by looking at box 10 (“other”) of irs form 1098. Property tax = value of the property x tax rate » use our property tax calculator to see.

Property tax is typically determined by multiplying the value of the property by a tax rate: For property tax exmeption, contact your county tax office. To determine the amount of property tax due, divide your propertys assessed value by $100, then multiply that amount by the property tax rate.

To locate the amount of your secured property taxes, click the following link how much are my property taxes? Visit the website of the county assessor to which you pay property taxes. Search valuable data on properties such as liens, taxes, comps, foreclosures & more.

See property records, tax, titles, owner info & more. Turbotax is the easy way to prepare your personal income taxes online. A rate is developed by dividing the total tax levy by the total assessed value in order to determine each property tax payer's share of the levy.

1) look up county property records by address 2) get owner, taxes, deeds & title. Review your bank or credit card records if you paid the property/real. Enter appropriate data into the search field based on your selection.

There are several ways to find out how much you paid in property taxes over the course of a year, but the simplest is probably to look through your own records. Locate the property search link. Property tax & billing information.